Comparing "Forward" and "Futures" Exchange Contracts, We Can Say That

Essentially, forward and futures contracts are agreements that allow traders, investors, and article producers to speculate on the future price of an asset. These contracts function as a two-party commitment that enables the trading of an instrument on a future date (expiration date), at a price agreed upon at the moment the contract is created.

The underlying financial instrument of a frontward or futures contract can be any asset, such as disinterestedness, a article, a currency, an interest payment or fifty-fifty a bond.

However, unlike forrard contracts, the futures contracts are standardized from a contract perspective (every bit legal agreements) and are traded on specific venues (futures contracts exchanges). Therefore, futures contracts are subject to a particular set of rules, which may include, for instance, the size of the contracts and the daily interest rates. In many cases, the execution of futures contracts is guaranteed by a clearing house, making information technology possible for parties to trade with reduced counterparty risks.

Although primitive forms of futures markets were created in Europe during the 17th century, the Dōjima Rice Exchange (Nippon) is regarded every bit the first futures exchange to be established. In early 18th-century Japan, most payments were made in rice, so futures contracts started to be used as a fashion to hedge against the risks associated with unstable rice prices.

With the emergence of electronic trading systems, the popularity of futures contracts, along with a range of use-cases, became widespread beyond the entire financial industry.

Functions of futures contracts

Within the financial industry context, futures contracts typically serve some of the post-obit functions:

-

Hedging and risk management: futures contracts can be utilized to mitigate against a specific risk. For example, a farmer may sell futures contracts for their products to ensure they get a certain cost in the futurity, despite unfavorable events and market fluctuations. Or a Japanese investor that owns U.s. Treasury bonds may buy JPYUSD futures contracts for the amount equal to the quarterly coupon payment (interest rates) every bit a fashion to lock the value of the coupon in JPY at a predefined rate and, thus, hedging his USD exposure.

-

Leverage: futures contracts allow investors to create leveraged positions. As contracts are settled at the expiration date, investors are able to leverage their position. For example, a 3:1 leverage allows traders to enter into a position iii times larger than their trading account balance.

-

Short exposure: futures contracts allow investors to have a short exposure to an asset. When an investor decides to sell futures contracts without owning the underlying asset, it is commonly referred to equally a "naked position".

-

Asset variety: investors are able to take exposure to avails that are difficult to exist traded on the spot. Bolt such as oil are typically costly to deliver and involve high storage expenses, but through the apply of futures contracts, investors and traders can speculate on a wider multifariousness of nugget classes without having to physically trade them.

-

Toll discovery: futures markets are a ane-stop-shop for sellers and buyers (i.east. supply and demand run across) for several nugget classes, such every bit commodities. For example, the price of oil can exist determined in relation to real-time demand on futures markets rather than through local interaction at a gas station.

Settlement mechanisms

The expiration date of a futures contract is the last 24-hour interval of trading activities for that particular contract. Subsequently that, trading is halted and the contracts are settled. In that location are two primary mechanisms for futures contracts settlement:

-

Physical settlement: the underlying asset is exchanged betwixt the two parties that agreed on a contract at a predefined price. The political party that was short (sold) has the obligation to deliver the asset to the party that was long (bought).

-

Cash settlement: the underlying asset is not exchanged directly. Instead, one party pays the other an amount that reflects the current nugget value. 1 typical case of a greenbacks-settled futures contract is an oil futures contract, where cash is exchanged rather than oil barrels every bit it would exist fairly complicated to physically trade thousands of barrels.

Greenbacks-settled futures contracts are more convenient and, therefore, more than pop than concrete-settled contracts, fifty-fifty for liquid financial securities or stock-still-income instruments whose buying tin can be transferred fairly apace (at least comparing to physical assets like barrels of oil).

Nonetheless, cash-settled futures contracts may lead to manipulation of the underlying asset toll. This type of market place manipulation is commonly referred to as "banging the close" - which is a term that describes aberrant trading activities that intentionally disrupt orders books when the futures contracts are getting close to their expiration date.

Leave strategies for futures contracts

Later on taking a futures contract position, in that location are three master deportment that futures traders can perform:

-

Offsetting:refers to the human activity of closing a futures contract position by creating an opposite transaction of the aforementioned value. So, if a trader is curt 50 futures contracts, they can open a long position of equal size, neutralizing their initial position. The offsetting strategy allows traders to realize their profits or losses prior to the settlement appointment.

-

Rollover:occurs when a trader decides to open a new futures contract position after offsetting their initial one, essentially extending the expiration appointment. For instance, if a trader is long on 30 futures contracts that expire in the beginning calendar week January, just they want to prolong their position for vi months, they can commencement the initial position and open up a new ane of the same size, with the expiration date set to the first week of July.

-

Settlement: if a futures trader does not commencement or rollover their position, the contract will be settled at the expiration date. At this point, the involved parties are legally obligated to exchange their avails (or cash) according to their position.

Futures contracts price patterns: contango and normal backwardation

From the moment futures contracts are created until their settlement, the contracts market price volition be constantly changing every bit a response to ownership and selling forces.

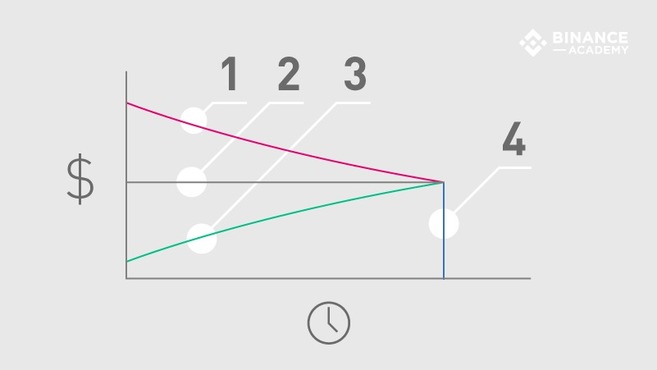

The relation between the maturity and varying prices of the futures contracts generate different toll patterns, which are commonly referred to equally contango (i) and normal backwardation (3). These toll patterns are directly related to the expected spot price (2) of an nugget at the expiration date (4), as illustrated below.

-

Contango (1) : a marketplace condition where the price of a futures contract is college than the expected future spot price.

-

Expected spot toll (2): anticipated asset price at the moment of settlement (expiration date). Note that the expected spot price is non always constant, i.eastward., information technology may change in response to market place supply and need.

-

Normal backwardation (iii): a market condition where the price of futures contracts is lower than the expected future spot price.

-

Expiration date (iv):the last twenty-four hour period of trading activities for a particular futures contract, before settlement occurs.

While contango market conditions tend to be more favorable for sellers (short positions) than buyers (long positions), normal backwardation markets are ordinarily more benign for buyers.

As it gets closer to the expiration appointment, the futures contract price is expected to gradually converge to the spot price until they eventually have the aforementioned value. If the futures contract and spot cost are non the aforementioned at the expiration date, traders volition exist able to make quick profits from arbitrage opportunities.

In a contango scenario, futures contracts are traded above the expected spot price, usually for convenience reasons. For instance, a futures trader may make up one's mind to pay a premium for physical commodities that will be delivered in a future date, so they don't demand to worry about paying for expenses such as storage and insurance (gilt is a popular example). Additionally, companies may use futures contracts to lock their future expenses on predictable values, ownership commodities that are indispensable for their service (due east.one thousand., bread producer buying wheat futures contracts).

On the other hand, a normal backwardation market takes place when futures contracts are traded beneath the expected spot cost. Speculators buy futures contracts hoping to brand a profit if the price goes up equally expected. For example, a futures trader may purchase oil barrels contracts for $30 each today, while the expected spot price is $45 for the next yr.

Closing thoughts

Equally a standardized type of forward contract, futures contracts are among the most used tools within the financial industry and their various functionalities make them suitable for a wide range of apply cases. Still, it is important to have a good understanding of the underlying mechanisms of futures contracts and their particular markets before investing funds.

While "locking" an nugget's toll in the future is useful in sure circumstances, it is non always safe - peculiarly when the contracts are traded on margin. Therefore, risk direction strategies are frequently employed to mitigate the inevitable risks associated with futures contracts trading. Some speculators too use technical analysis indicators forth with fundamental analysis methods equally a way to go insights into the price action of futures markets.

Source: https://academy.binance.com/en/articles/what-are-forward-and-futures-contracts

0 Response to "Comparing "Forward" and "Futures" Exchange Contracts, We Can Say That"

ارسال یک نظر